Buying a home for the first time can be complex and stressful but also an exciting experience. When shopping for a home, it’s important to know what you’re getting yourself into. Staying organized, understanding the mortgage process, and finding the best mortgage lender will make the purchasing process smoother and faster. According to NerdWallet, “You want to work with a lender that can give you the best rate, the right term, and the lowest closing costs, as quickly and efficiently as possible.” Here are some tips for first-time home buyers looking for the best mortgage lender.

Understanding the Mortgage Process

Before approaching a lender, read up on the mortgage process. First, make sure to review your credit. MPA Magazine says, “Lenders scrutinize your credit history when deciding if they will offer you a mortgage – as well as the interest rate on the home loan.” Getting a free credit report from major credit bureaus or your bank lets you know of any unpaid or high balances that could prevent you from getting a mortgage in your budget.

Figuring out your budget beforehand also provides an idea of how much you can put down and what you can afford to pay in interest payments, home insurance, property taxes, and potentially private mortgage insurance. According to MPA Magazine, if you start saving money early, you will likely have more money to put towards a down payment and other expenses helping you borrow less and make your monthly mortgage payments less. Budgeting and saving money for a better down payment makes you a more attractive buyer in a competitive real estate market.

Finally, understanding the mortgage options and the different loan structures will help you meet the minimum requirements of that loan. MPA Magazine mentions that three government-backed loans come from the Federal Housing Authority (FHA), Veterans Affairs (VA), and the USDA. Many conventional loans offer different loan structures for term length and fixed-versus adjustable rates. Understanding the ins and outs of each loan will help you plan for budgeting and leave you without surprises when it’s time to apply for a loan.

Choosing a Mortgage Lender

Once you research and apply to multiple mortgage lenders, it’s time to decide on a lender that follows your plan and budget but is also experienced. Remember what type of service and lending experience is essential during this process to you. For example, do you want someone in person or prefer to do the entire process over an app? Asking these questions will help you narrow down where you want to apply for a loan, and based on each loan estimate, you can then decide what lender is giving you the best mix of rates and fees and is meeting your personal preferences and goals.

Planning, budgeting, and researching all play a key role in helping you find the best mortgage lender and making the process easy as a first-time home buyer. Most of the time, first-time home buyers need help finding the right mortgage, but you should always look for a lender that gives you the best rate, the right term, and the lowest closing costs as quickly and efficiently as possible.

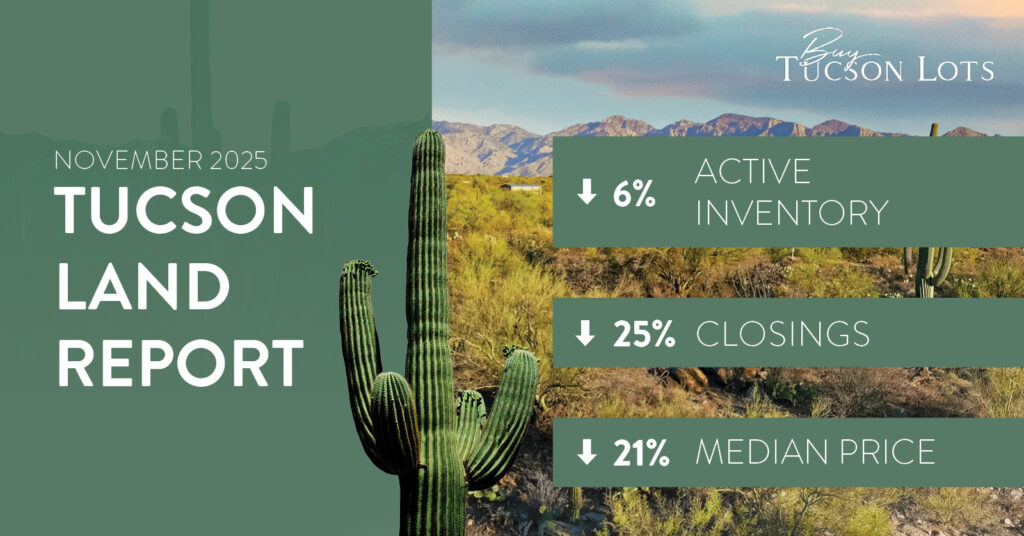

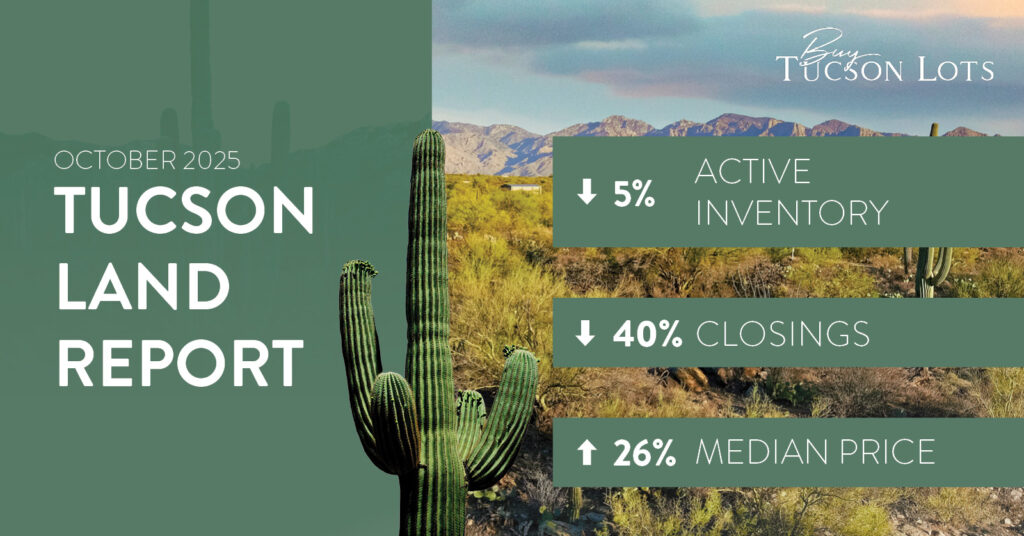

Are you starting to look to purchase your ideal parcel of land to build a custom first home around Tucson, Arizona? Contact me, Rick Sack, by phone at 520.918.5477 or by email at rick@buytucsonlots.com, and I’ll help you find the best lot of vacant land for you and your family.