When you finance a home, you have many loan options to pick from. Each type of mortgage has its advantages and disadvantages, from government-backed loans to private loans, one option you might encounter during your search is a conventional mortgage.

What Separates a Conventional Mortgage From the Rest?

A conventional mortgage, also known as a “conforming loan,” is distinct from other home loans because the government neither guarantees nor insures it. Instead, private lenders, such as banks and credit unions, offer conventional mortgages to government-backed entities and qualified home buyers.

Forbes Advisor says, “Even though a conventional loan is the most common mortgage, it is surprisingly difficult to get. Borrowers need to have a minimum credit score of about 620 in order to qualify and have a debt-to-income ratio of 43% or less. Borrowers also need to be able to afford a down payment of 20% or more in order to avoid mortgage insurance.”

Conventional mortgages make up most of all home loans. However, conventional loans entail stricter credit requirements than government-backed loans.

Meeting Eligibility Requirements

To qualify for a conventional mortgage, you must meet specific criteria. This requires a good credit score, proof of income, and a stable financial history. You must also make a sufficient down payment, usually at least 5-20% of the home’s purchase price.

Rocket Mortgage states that first-time home buyers can get a conventional mortgage with a low down payment. However, it depends on your situation and the loan or property you’re purchasing.

Investing in Your Down Payment

The size of your down payment can significantly impact the interest rate and terms of the loan. By making a larger down payment, you show the lender that you are a financially responsible borrower, which can result in a lower interest rate and more favorable loan terms. However, certain circumstances can lead to you having to put in a higher or lower down payment. For example, Rocket Mortgage lists:

- If you’re not a first-time home buyer or makeup at most 80% of the median income in your area, the down payment requirement is 5%.

- If the house you’re buying is not a single-family home (i.e., it has more than one unit), you may need to put down 15%.

- You’ll need to put at least 10% down if you buy a second home.

- The minimum down payment requirement is 5% if you get an adjustable-rate mortgage.

Understanding Interest Rates

Conventional mortgages typically have higher interest rates than government-backed loans because lenders are considered to be at high risk since the government does not guarantee them.

According to Rocket Mortgage, “While many sites can give you estimated conventional loan interest rates, the best way to see your actual interest rate for a mortgage is to apply.” Talking with different lenders and understanding the process and interest rates can help the buyer choose the best lender for their home. Buyers need to keep in mind that their credit score, income, and down payment all determine a conventional mortgage’s interest rate. Unprepared buyers normally face higher interest rates and problems when getting a conventional loan.

Satisfying Underwriting Requirements

Lenders impose more stringent underwriting requirements for conventional mortgages than government-backed loans. They will thoroughly review your financial history, including your credit score, income, and employment history

The lender will also consider the value of the property and your down payment amount to determine your eligibility for the loan. Knowing what lenders are looking for before applying for a conventional loan increases your chances of getting the mortgage you can afford.

Advantages of Choosing a Conventional Mortgage

Conventional mortgages offer greater flexibility in terms of property types and loan amounts. For instance, you can use a conventional mortgage to buy a vacation home, an investment property, or a second home. Additionally, you can use conventional mortgages to finance higher-priced homes, as they are not limited by the maximum loan amounts set by the government. Conventional mortgages broaden the market for first-time home buyers and offer experienced buyers the ability to expand their real estate portfolio.

Disadvantages of a Conventional Mortgage

Compared to government-backed loans, conventional mortgages have a higher interest rate. This can increase your monthly mortgage payment, making it harder for borrowers to afford. Additionally, stringent underwriting requirements can make qualifying for a conventional mortgage more challenging.

In conclusion, a conventional mortgage is a home loan offered by private lenders without government guarantees or insurance. While it provides more flexibility in different properties and loan amounts, it also carries higher interest rates and meticulous financial requirements than government-backed loans. When you decide on a conventional mortgage, carefully evaluate your financial situation and consider factors like your credit score, income, and down payment amount before applying.

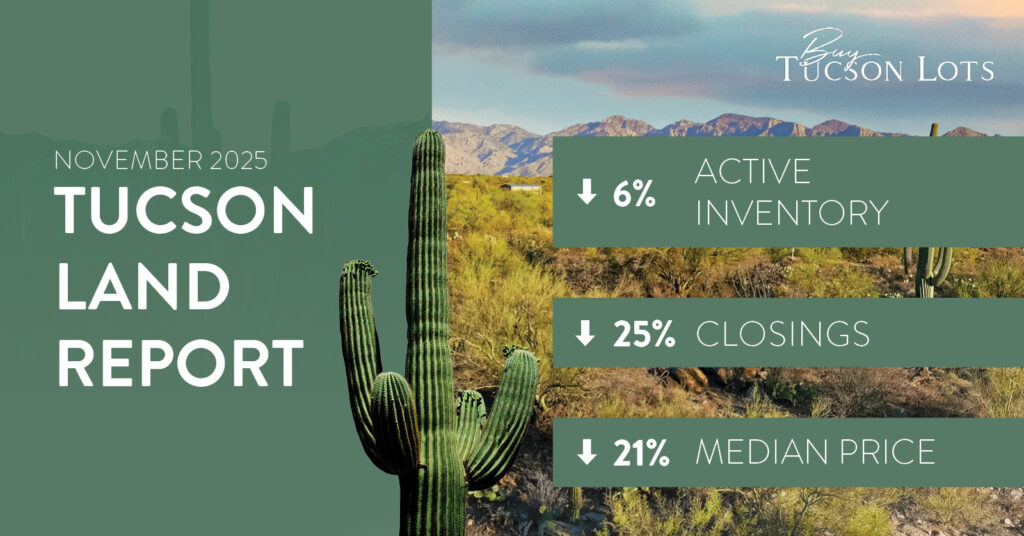

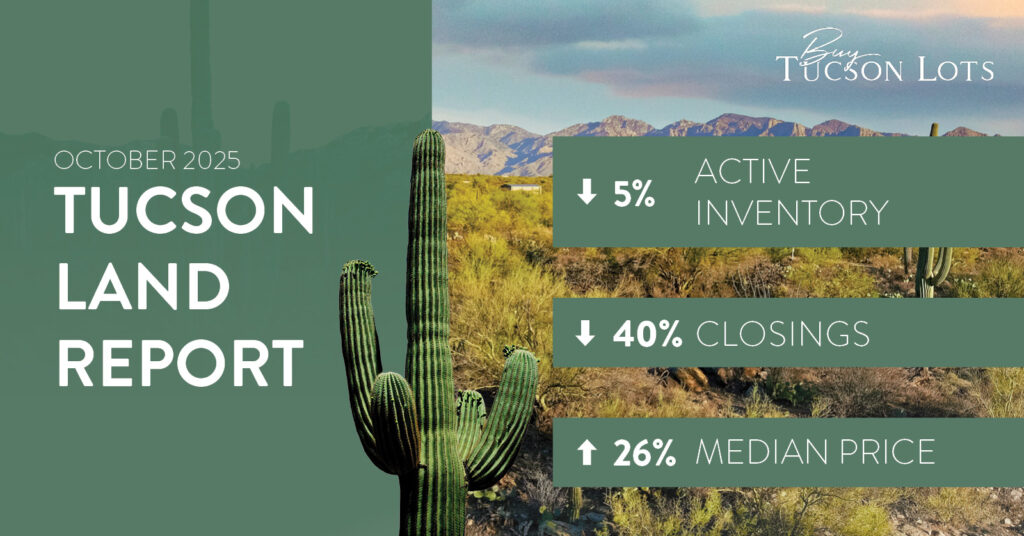

Are you researching the different types of mortgages? If you are looking to purchase your ideal parcel of land in Tucson, Arizona, contact me, Rick Sack, by phone at 520.918-5477 or rick@buytucsonlots.com. I can help you find the best lot or vacant land parcel for you and your family!